[/imageframe][/one_full][/fullwidth]

[/imageframe][/one_full][/fullwidth]

Every day we make money decisions. From what we buy for lunch, to the clothes we wear to where we choose to live, everything has a financial implication.

And, just like deciding what to eat, money decisions are emotional decisions made in the moment, often with little thought or consideration to their impacts down the line. Unfortunately just as poor food choices can satisfy our short-term needs but lead to a future health and energy debt, poor money decisions can lead to economic debt and distress that takes up an enormous amount of mental, emotional and physical energy to put right. With food, it’s very easy to blame the person who is surrounded by cheap, tempting food and drink in fast food restaurants and supermarkets for succumbing to temptation. Yet, it’s the same with money. In today’s multifaceted, complex, consumer world, we’re surrounded by cheap credit, weighed down by large mortgages and student loans and have to make big, important decisions about pensions and investments in increasingly sophisticated financial markets.

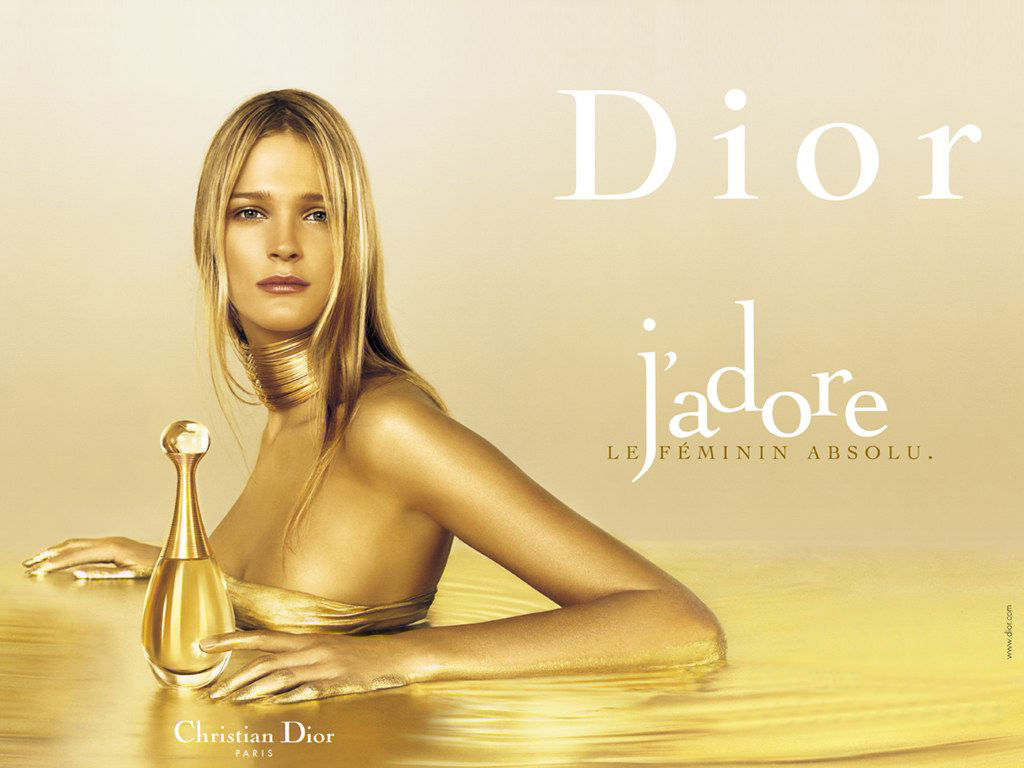

Will I really be more loveable or feminine if I use this brand of perfume?

And temptations are everywhere – every time we look at our phone, device or venture outside, we are bombarded by a multitude of tempting offers to swap our hard-earned money for. By praying on our human need for external validation, many brands have clever marketing campaigns that tap into our human desires that make us believe that their products will make us more than we perceive ourselves to be.

The sad and real truth is that many people are under financial stress.

According to the American Psychological Association, money continues to be the biggest source of stress in people’s lives. In an eye-opening article in the Atlantic, Americans from all walks of life find it difficult to find even an extra $400 for an emergency… including the author of the Atlantic article himself! And the same applies to people worldwide.

It’s not just the practical considerations, but the emotional ones too. A few years ago, my partner Lawrence attended a workshop entitled ‘What is Your Money Story?’ It was fascinating for him to dig deeper into his past and realise what he was telling himself about money, all without a conscious realisation that he was doing it! His early life experiences had left him with a belief that money was in limited supply and that he had to work very hard for it. As he grew older and had new experiences, that view was challenged and was replaced with a new story that has served him much better.

The truth is that we live in an abundant world.

This may seem hard to believe, but when we open ourselves up to receiving money and truly believe we deserve it, the floodgates open and wealth starts to build. Another way to look at money is ‘money energy’ – when you change your vibration to be attractive to money, money will begin to flow your way, in a similar way to when you tune in an am/fm radio, when correctly tuned it will receive the correct signal.

Wherever you are with your financial wellbeing, here are 14 habits you can incorporate into your life to keep money in its rightful place, as a tool to buy the things you need and improve your financial wellbeing.

-

-

Ask yourself what your money story is. If you uncover that you have an issue with money, for instance thinking that ‘money is bad’ or ’rich people are evil’ or even ‘I don’t deserve to be rich’, ask yourself where this belief is coming from. Then find ways to change your beliefs into more positive ideals such as ‘money is a great tool for doing good things and helping people’ and ‘money flows easily and abundantly to me’. Aim to truly believe that money is good. Which, of course it is, if it is in the hands of a person whose intentions are good (ie. You!). And that you deserve it (Which of course, you do!) The press is littered with lottery winners and ex-pro-sports(wo)men, who went on to lose everything, because their feeling that they didn’t deserve it went so deep, that they unwittingly sabotaged their own success and pushed their wealth away.

-

-

-

Get educated. As a 2014 study showed, 70% of people could not answer 3 relatively simple questions about money. Try them for yourself. Be honest. If you don’t get all 3 questions right, make a decision to learn a few basics – it could truly be the difference between a fantastic retirement and a terrible one.

-

-

-

Get compound growth on your side. Many people are on the wrong side of it, paying off credit cards, car loans and other interest, which may mean you pay considerably more than the item originally cost (take your mobile phone for example – are you on a 12-24 month plan that included a “free” phone? Do the maths and you’ll most likely find you will pay around double what you would have paid if you’d just paid for the phone in the first place and opted for the most basic tariff). If you get compound growth on your side, you will earn growth on your growth. This makes wealth happen faster than you can imagine!

-

-

-

Think of yourself as a business and work out how you can grow your value by doing things of value to others. Adopt common accountancy structures for your personal finance like a month-end system, quarterly reviews and forecasts so you’re always on top of your financial situation.

-

-

-

On similar lines, track your spend. It’s easy to spend, spend, spend and then get a big shock when the bill comes through. Using apps like YNAB where ‘every $ has a job’, you can keep on top of your spending habits and make decisions to divert resources. People often find that they are spending $1k per year on coffee! (Tip: invest in a flask and make your own!)

-

-

-

When on the verge of buying something, ask yourself ‘Do I really need this?’ I have saved a ton of money over the years, just by doing this one! People are drowning in a homefull of ‘stuff ‘that is neither needed nor appreciated (and sometimes not even used). It all needs to be put somewhere too, so adds to a feeling of being cluttered and out of control. Aim to alleviate the instant gratification of something shiny and new for the joy of seeing your savings and investments growing and therefore your future. Try turning it into a game. Count how many times in a day that you can say ‘No!’ to buying something, and watch your score rack up. The more the merrier!

-

-

-

Go environmental and use freecycle or charity shops wherever you can. You’d be surprised what great, original things you can find, at incredible prices!

-

-

-

Save between 10 and 20% of your income, and forget about it. Setting this up as a direct debit will enable you to gradually grow your savings account. Do this consistently.

-

-

-

Pay off your credit card bills in full every month to avoid interest. I’ve done this consistently since I first got a credit card back in 1992 when I was earning very little. Credit cards often have the highest rates of interest anywhere, so if you are going to pay interest, avoid credit cards if you can.

-

-

-

Maximise tax-savings vehicles such as ISA’s in the UK and IRAs in the US. [Come on Australia, we need something like this here!]

-

-

-

Invest in buckets of stocks, rather than single stocks, in order to spread the risk. Many people like to invest in index funds, which are great for people that don’t have the time or interest to watch individual shares, but still want to receive the growth from a basket of good companies. Try Vanguard, which is famous for charging the cheapest fees of any index funds.

-

-

-

Pay attention to fees and avoid actively managed funds, as they have high hidden fees that most investors are unaware of, that eat into your returns.

-

-

-

Don’t just invest in shares, but diversify into other investment classes. There are so many ways to invest money and the more uncorrelated they are with each other, the more you will save if one moves into a negative cycle.

-

-

-

Check you have insurance in place, in case the worst happens.

-

So, there we have it: 14 ways to improve your financial well being. How many of these can you implement this week?

Money can be a real taboo subject, so people are not as educated about it as they could be if it was spoken about more. However, there are many simple things you can do to empower yourself about money, from the practical the emotional.

Remember, you really DO deserve to be happy, and wealthy, and to live a good life. So, truly believe it – then go on to serve people, tell yourself that money is flowing towards you and go forth and achieve all of your most cherished dreams!

Heather Mitchell is a money coach and successful investor, who looks beyond the obvious to uncover financial blocks, teaching wealthy habits that, once adopted, can lead to breakthroughs and great wealth. Click here to get in touch.

Want to find out more? Contact us here to get a free 45-min strategy session to find out how we can transform your financial health and empower you to live the life that you deserve.