4 reasons why people don’t save and invest - and why you should do it anyway

Everyone should save and invest a percentage of their earnings.

Why?

Because if you don’t, you are not maximising as much value as you can from life. (I know that’s a big statement, but it’s true.)

Say you receive a total of 10k in your account every month, and you simply spend the whole lot each month. Then, you would end the month with no profit. The same for the year. Nothing to show for it. Zilch. Except for the ‘stuff’ you accumulated, which is now worth a fraction of what you paid for it.

However, instead of spending all of it, if you saved 10% of it (1k), then for starters you would be pocketing 12k per year.

But, to get even more value from it, by investing it, you could make even more. At 5% annual return, after 10 years, you would have a total of 154,363, which includes over 34,000 in gains (effectively free money you wouldn’t have otherwise had!)

So, if you don’t invest now, what is stopping you? For the majority it’s one of these 4 reasons:

1. You do not have enough time

Yes – that’s a common one. People are so busy these days, that it is incredibly difficult to fit in extra tasks in such a packed schedule. But think of this: isn’t it worth the investment in time in order to get more time back? Money could buy you a cleaner, a housekeeper or a virtual assistant, so the investment in your finances now will give you back so much time later. So, what can we take off your schedule in order for you to find more time? Spend any time on social media? On Netflix? Watching the news? Do you have a daily commute? With some creativity, you can find time for this key pursuit.

2. You do not have the money

I get it. Life is expensive. There’s so much you need. Clothes for work. Education and stuff for the kids. Housing. Food. Transport…. It all adds up.

But, in the list of the things you buy, are there things that are more ‘luxuries’ that you could give up? The cable or Netflix subscription? The tickets to ball games or cinema. Those restaurant meals you treat yourself with. If you had a delve into what you spent money on, there may be a few things you could do without, for the greater good.

And, what is the greater good? It is simply this: the money that you save by not buying these things now, allowed to grow instead will buy you 10 or more of those same things in the future. Isn’t that a great reason to not buy them just yet?

3. You do not know how to invest money

This sadly is the case for many people. Two thirds of Americans could not pass a basic literacy test, a third of Americans have zero saved for retirement and 44% would not be able to find $400 for an emergency.

It is so important that you educate yourself on how to manage your money well and put that learning into action. It is not rocket science and there is plenty of info available on the internet. Of course, you can also hire a financial wellbeing coach like yours truly ;-)

4. You are worried that you will lose it

That is a valid concern. Perhaps you know someone who has lost a lot of money in the stock market. Or maybe you’ve been burnt yourself. But, just because there is some risk, it doesn’t mean you shouldn’t do it at all. There are risks everywhere, but if we didn’t do anything with any risk, we wouldn’t do anything. Take driving. There’s a risk that you could have an accident, but for most people that isn’t enough to stop them from jumping behind the wheel. Even if they’ve had an accident before, they have still got back in the car and proceeded anyway (perhaps more cautiously at first) but they plough on regardless.

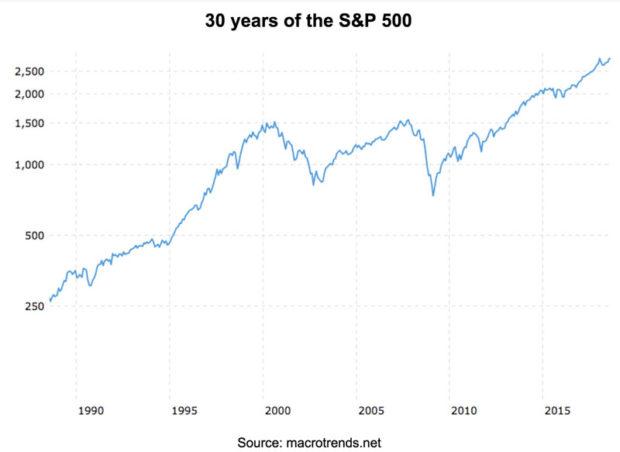

This is a chart of value of the US stock market (the S&P) over the past 30 years. As you can see, there is the Dot Com Bubble in 2000 and the Global Financial Crisis in 2008. Looked at from this perspective, these now seem like blips and both pale in comparison with today’s valuations.

And, since its inception in 1926, the stock market has an average yearly return of 10%. So, how much money have you left on the table by not “putting in some skin?”

For me, having lived through both crashes and walked away from both unscathed, the secret is all about diversification, which means investing in a variety of different things. And when I say ‘different things’, I mean just that. A variety of things. That don’t all move together in a crash. So, stocks (different sectors, different countries), dividend stocks, property (different sectors and countries), bonds, small businesses, art, wine, collectibles… the list goes on.

Each and every one is like a mini cash machine, generating growth and payouts for its owners. (That is, you).

So, if you are not saving and investing, why not start now? Today. Commit a small amount at first, but commit something. And keep doing it. Automate it to ensure it happens.

Your future self will be grateful that you did.

Heather is a holistic financial wellbeing coach. Her aim is to educate women entrepreneurs around money and finances, so that they take back their power.

Want to find out more? Contact us here to get a free 45-min strategy session to find out how we can empower you to save and invest and live the life that you deserve.